Hourly rate paye calculator

Next divide this number from the. To protect workers many.

Salary To Hourly Salary Converter Salary Hour Calculators

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

. Hours Health Leave Year. To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12. Hours Annual Leave Year.

Find out the benefit of that overtime. First calculate the number of hours per year Sara works. Then enter the number of hours worked and the employees hourly rate.

Ad See the Calculator Tools your competitors are already using - Start Now. If you get paid bi-weekly once every two weeks your gross paycheck will be 2308. A salary or wage is the payment from an employer to a worker for the time and works contributed.

States dont impose their own income tax for. This number is based on 37 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

See where that hard-earned money goes - Federal Income Tax Social Security and. For example for 5 hours a month at time and a half enter 5 15. Salary Calculator 202223 SalaryBot.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. If you get paid bi. How to Convert Monthly Salary to Hourly Pay.

Hourly Paycheck and Payroll Calculator. Need help calculating paychecks. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

Then divide the resultant value by the. Follow the simple steps below and then click the Calculate button to see. KiwiSaver Employer Contribution Year.

Yearly salary 52 weeks 375 hours per. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. For example if an employee makes 25.

Federal income tax rates range from 10 up to a top marginal rate of 37. 37 x 50. Read reviews on the premier Calculator Tools in the industry.

How do I calculate hourly rate. Read reviews on the premier Calculator Tools in the industry. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off.

There are two options. Yes the personal income tax in Massachusetts is a flat rate. Use the Pay Raise Calculator to determine your pay raise and see a comparison before and after the salary increase.

Ad See the Calculator Tools your competitors are already using - Start Now. Related Take Home Pay Calculator Income Tax Calculator. Hours Worked Year.

Median household income in 2020 was 67340. See where that hard-earned money goes - with UK income tax National. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

To calculate annual salary to hourly wage we use this formula. Enter the number of hours and the rate at which you will get paid. Hours Paid Year.

A yearly salary of 28000 is 1455 per hour.

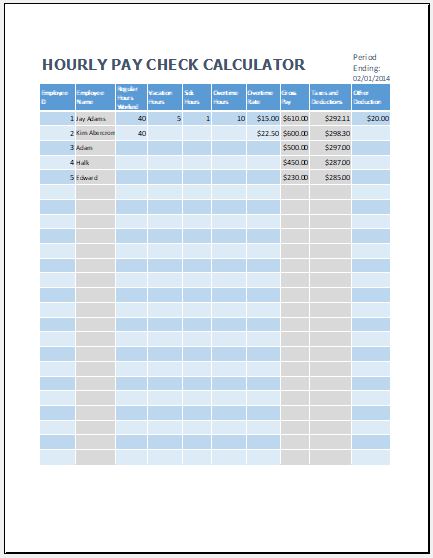

Hourly Paycheck Calculator Template For Excel Excel Templates

Paye Calculator Sonovate

Hourly Rate Calculator

Paycheck Calculator Take Home Pay Calculator

Annual Income Calculator Best Sale 55 Off Www Ingeniovirtual Com

Tax Calculator For Wages Online 55 Off Www Ingeniovirtual Com

Tax Calculator For Weekly Pay Hot Sale 50 Off Www Ingeniovirtual Com

Tax Calculator For Weekly Pay Best Sale 58 Off Www Ingeniovirtual Com

Annual Income Calculator

Hourly Rate Calculator

Hourly To Salary What Is My Annual Income

Hourly To Salary Calculator Convert Your Wages Indeed Com

Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Annual Income Calculator Best Sale 55 Off Www Ingeniovirtual Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator